A complete analysis of the financial statements of leading lending protocols and ETH/SOL staking platforms reveals a project hasn't been profitable for five years.

- Looping has become the primary strategy in DeFi lending, strengthening the fundamentals of leading lending platforms and eliminating protocols that fail to keep up with market trends.

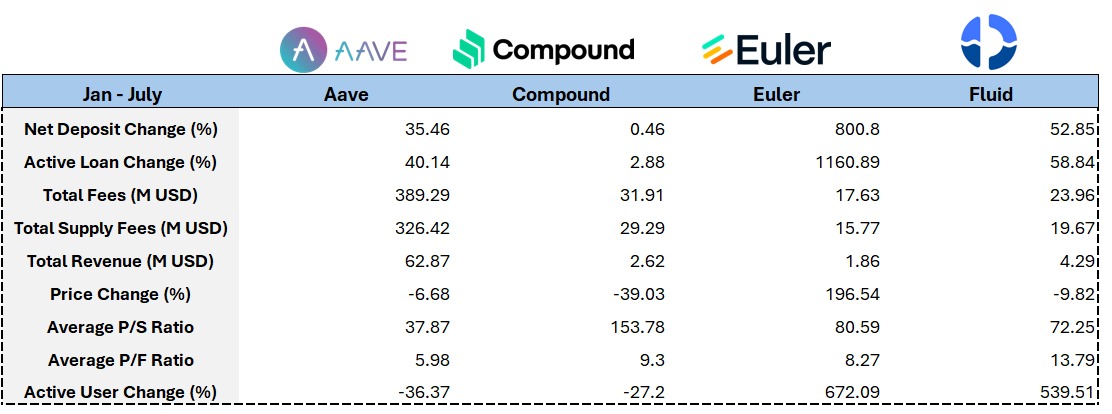

- Euler Finance, with its EVK framework that lets anyone deploy custom lending vaults, has seen explosive growth in both core metrics and token prices. Looking ahead, the integration of RWA (real-world asset) lending could serve as a major new catalyst.

- Aave has benefitted from the launches of USDe, PT-USDe, the Umbrella risk mitigation mechanism, and GHO’s cross-chain issuance, all contributing to robust growth throughout the first half of the year.

- Lido Finance’s revenue model has produced strong topline results. The sector’s growth potential now increasingly depends on institutional demand from Wall Street for ETH staking yields.

- Jito’s operational strength in MEV infrastructure, its dominance with jitoSOL, and the expansion of restaking use cases on Jito have fueled an aggressive upward trend since Q2 2025.

What are the sources of lending protocol revenue?

The bulk of revenue stems from the total interest paid across all borrowing positions—open, closed, or liquidated. This interest income is split proportionally between liquidity providers and the protocol’s DAO treasury.

When a borrowing position breaches its designated LTV threshold, the protocol allows liquidators to initiate liquidation. Each asset class carries a specific liquidation penalty, and the protocol claims the collateral, which is then either auctioned or processed using Fluid’s liquidity liquidation mechanism.

What can we learn from Aave’s financials?

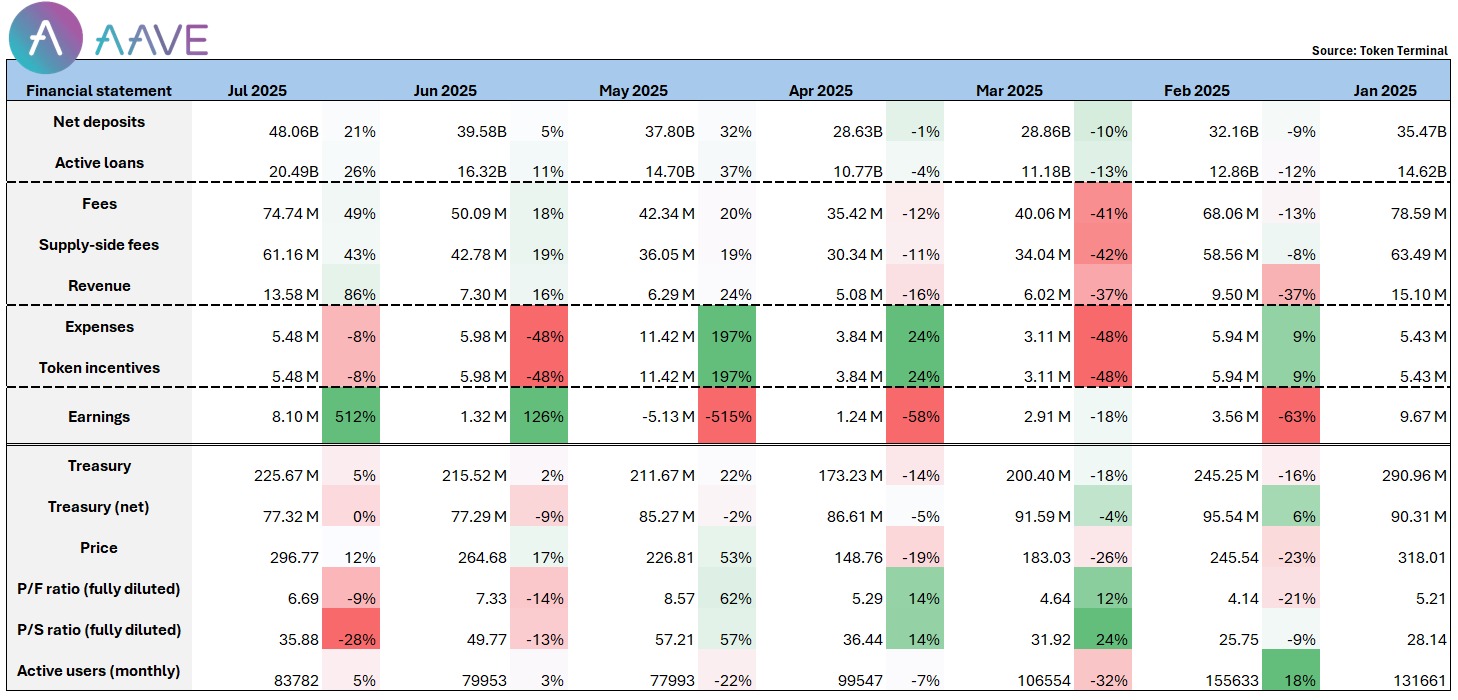

@aave’s protocol fees and revenue peaked at the start of the year, then gradually tapered off in line with a market-wide correction. I believe the rebound observed after May was largely driven by the introduction of USDe and PT-USDe, reflecting surging demand for looping strategies fueled by Pendle’s PT assets and Ethena’s new stablecoin.

Within days of the PT-sUSDe launch, nearly $100 million was deposited into Aave, underscoring immense demand.

The Umbrella risk mechanism went live in June, attracting approximately $300M in deposit protection funds. Concurrently, Aave’s native stablecoin GHO has steadily expanded its cross-chain presence, with around $200M in current circulation and growing multi-chain use cases.

Multiple tailwinds helped Aave achieve a breakout in July:

-Net deposits soared above $4.8 billion, making Aave the platform’s TVL leader;

- Monthly net profit in June surged nearly 5x, reaching ~$8M;

- Based on price-to-sales and price-to-earnings ratios, Aave remains undervalued within its sector.

Given strong growth momentum and a mature product suite, Aave is well-positioned to attract more institutional DeFi usage. Whether in fee revenue, TVL, or protocol profitability, Aave looks set for continued record-breaking performance, cementing its status as a DeFi leader.

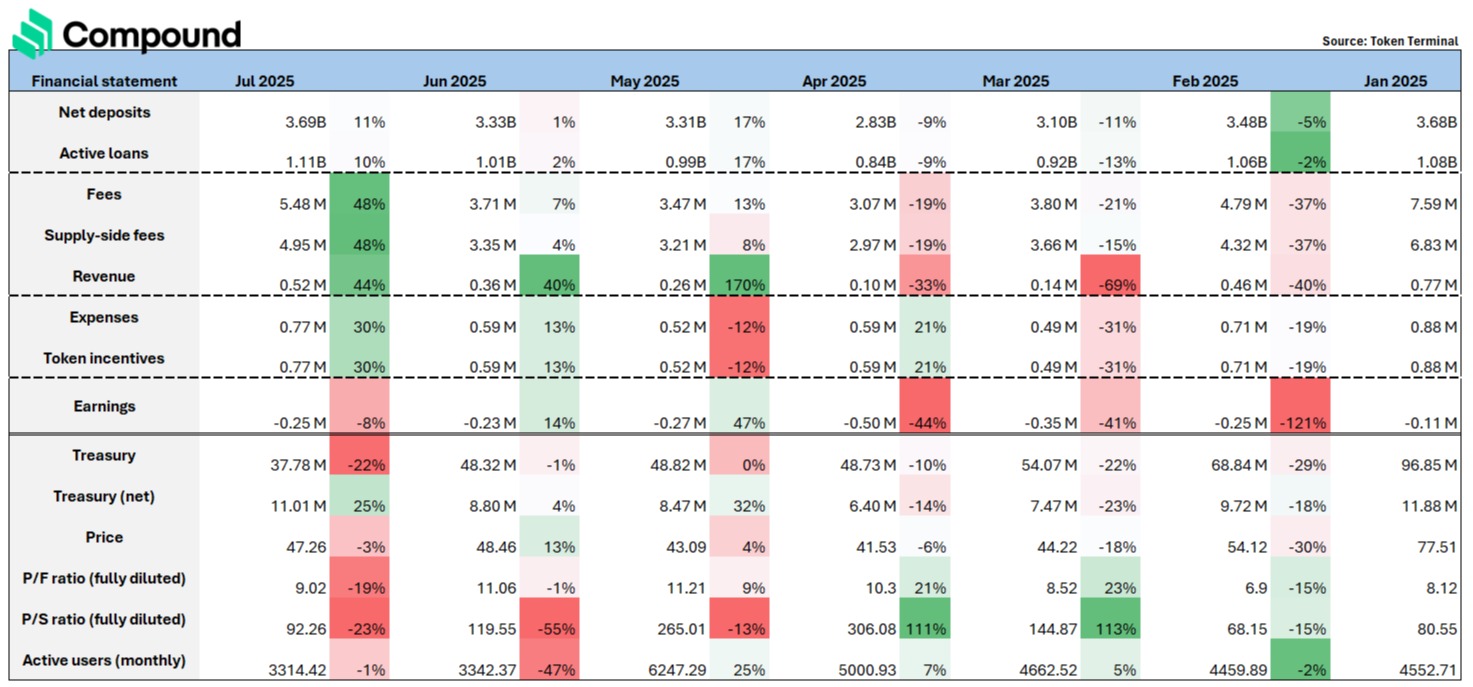

Are there signs of decline in Compound’s financials?

@compoundfinance, once a leading lending protocol, now clearly trails Aave in asset diversity and market responsiveness. While Aave quickly added restaked ETH (rETH, ETHx, cbETH), staked BTC (lBTC, tBTC), and Pendle’s PT assets, Compound continues to lag in support for these innovations.

With limited asset support, Compound’s lending features remain basic, missing out on looping use cases and composability. This has led to low user retention and poor capital efficiency. Financially, since early 2025, Compound has continuously posted net losses (between –$0.11M and –$0.25M) with its token price tumbling roughly 40%.

In today’s DeFi ecosystem, looping is foundational, and protocols like [Euler’s TVL, revenue, and token price are all surging@eulerfinance</a> stands out for its permissionless EVK (Euler Vault Kit"> framework, which enables any developer or protocol to launch custom vaults within Euler’s lending ecosystem. This flexibility directly caters to popular looping strategies and lets long-tail assets participate, boosting project revenue and user engagement.

<img src=”)

Just like Aave, after introducing the largest looping asset (PT-USDe) in April, Euler’s monthly income and TVL jumped by approximately 72% and 42% respectively—a testament to explosive growth.

For the first half of the year, Euler recorded the fastest growth rates for TVL (+800%) and active borrowing (+1160%) in the sector, outpacing peers and establishing its leadership in the lending space.

Euler has also forged partnerships with projects and platforms running airdrops (such as [Fluid: Technical moat delivers bullish fundamentals[](https://github.com/0xFluid “@0xFluid has emerged as one of the fastest-growing lending protocols after Euler, with TVL up about 53% year-to-date and now rivaling Euler’s locked value. Fluid’s meteoric rise is anchored in an innovative lending design and superior capital efficiency.

<img src=”)

Its core technical advantages—Smart Collateral and Smart Debt—let users pledge LP tokens (e.g., ETH/wstETH, USDT/USDC) as collateral, while borrowings are managed as adjustable LP asset pairs. These loan positions are then deployed into liquidity markets, earning users yield and offsetting borrowing costs.

This setup minimizes borrower interest expenses, generally offering lower rates than traditional models. Fluid also supports a higher average LTV than Aave and imposes a lower liquidation penalty (3% vs. Aave’s 5%), rivaling the efficiency of Aave’s e-mode.

Fluid’s integrated one-click looping is a standout, supporting ETH-collateralized stablecoin borrowing and immediate re-collateralization. Attractive deposit yields have even prompted whales to lock substantial capital for steady annual returns.

Notably, Aave invested $4M in FUID tokens and assisted in integrating its GHO stablecoin into Fluid’s pools—demonstrating confidence in Fluid’s model and backing its growth story.

Protocol revenue edged from $790K to $930K in the first half, showing stability, but the token has lagged. The key challenge remains insufficient token utility and the lack of a clear buyback mechanism—despite strong protocol performance, value accrual to the token still needs work.

Lido: The “ETH Beta” protocol’s financials

-————————————————————-

[

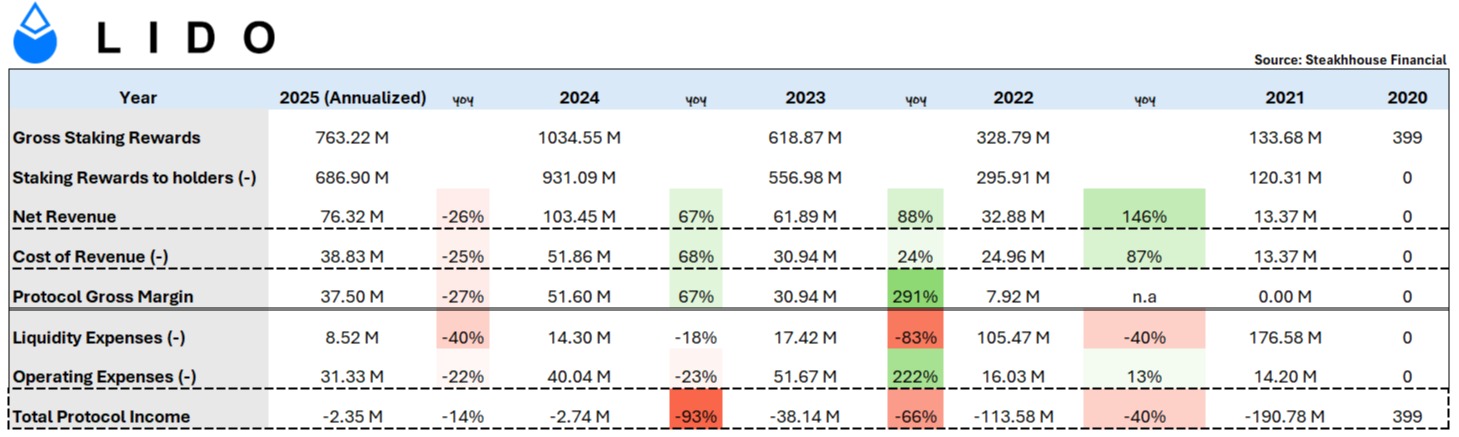

To understand this, we must examine the financials.

Staking Rewards: Lido’s main function is to aggregate user ETH, set up validator nodes, and distribute staking rewards back to depositors.

Crucially, most rewards aren’t retained by Lido itself. For example, in 2024, Lido generated $1.034B in staking rewards—but distributed $931M to stakers per protocol policy: 90% to stakers, 5% to node operators, and 5% to the DAO treasury.

- Cost of Revenue: Rewards to node operators plus slashing penalties (which are ultimately borne by Lido).

- Liquidity Expense: LP incentives for providing liquidity.

- Operational Expense: LEGO Grants (external grants for community/developer proposals) and TRP (token rewards for core DAO contributors).

The positive: Lido has meaningfully cut costs, with liquidity expense dropping to ~$8.5M in 2025, and operating expenses down 20% versus 2023. With revenue up 88%/67% over 2023/24 and tighter cost controls, net losses have shrunk by 66%/93%, falling to just ~$2M this year.

What’s next for Lido?

It may be harsh to claim the “ETH staking leader” underperforms, given that costs are steadily dropping, but persistent losses remain. The 10% protocol fee is an industry norm and unlikely to change.

The true growth lever is the scale of ETH staking. Relative to Solana/Sui/Avax/ADA, ETH’s staking rate is still low. A critical macro driver is Wall Street’s appetite for ETH staking yields; for instance, BlackRock has filed to enable ETH staking in its iShares ETF.

If this happens, ETH staking could become a mainstream institutional yield product, letting those holding ETH reserves generate extra yield and cash flow. If Lido (or Coinbase, or institutionally supported options like Puffer) becomes the preferred platform, the total market expands significantly. Staking rewards, however, will compress as network participation rises.

The Lido DAO is also considering proposals for LDO revenue sharing to boost token utility and align long-term value. The challenge: such mechanisms would further reduce protocol revenue and threaten sustainability. A more reasonable “excess surplus sharing” approach is also on the table.

Jito’s novel revenue stream: MEV tips

-——————————————————

@jito_sol</a> is the top player in SOL staking, outshining Lido in headline financials. Jito manages roughly 16M staked SOL (jitoSOL">, or 23% of the network.

The SOL staking rate—at 67.18%—is among the highest for any L1. Since October last year, Jito has delivered core infrastructure for liquid restaking, powering new restaking services and VRT (Vault Receipt Token) providers such as <a href=”)

- Bug Bounties: Paid to white hats for vulnerability disclosures.

- Liquidity Mining Incentives: Rewards for providing JitoSOL/VRT liquidity on DeFi platforms (e.g., Orca, Jupiter).

- Restaking Grants: Support for Node Consensus Network (NCN) developers and operators building restaking infrastructure.

- Interceptor Fees: Penalizes short-term arbitrage by freezing JitoSOL for 10 hours; early withdrawal triggers a 10% fee.

- JitoSOL Fees: 4% management fee is charged on staking rewards and MEV, netting out to an annualized 0.3% on user deposits (7% APY × 4%).

- Tip Routers: 3% of MEV tips are taken as protocol revenue each epoch (2.7% to the DAO, 0.15% to JTO stakers, 0.15% to JitoSOL holders).

Jito foundation strategies revealed in the financials

Liquidity incentives remain Jito’s largest cost, spiking in Q2 2024 and holding steady at $1M–$3M per quarter.

The driver: JIP-2 and JIP-13, allocating $JTO for DeFi incentives (mainly on @KaminoFinance). Since Q2 2024, JitoSOL income has climbed sharply, as DeFi looping via jitoSOL became more rewarding—raising demand for staking SOL, growing jitoSOL supply, and driving up income.

Since 2025, the foundation has set aside 14M JTO (~$24M) for incentives focused on boosting restaking and DeFi adoption of VRTs.

As of Q3 2025, about 7.7M JTO has been distributed. Revenue has grown by 36%, 67%, and 23% over the quarters—outpacing incentive spend—demonstrating positive returns on these initiatives.

On the revenue side, Tip Router and JitoSOL fees are the two pillars. From Q4 2024, Solana meme coin mania sent on-chain volumes surging, making Jito the prime beneficiary.

At the frenzy’s peak, Jito tips made up 41.6%–66% of Solana’s Real Economic Value (REV). Since Q2 2025, Tip Router profits have eclipsed JitoSOL fees, highlighting Jito’s MEV infrastructure edge. Solana traders routinely pay for “priority tips”—a unique economic engine among L1s.

Soaring Solana network activity, MEV infra, jitoSOL dominance, and emerging restaking use cases have pushed Jito’s net profit to a record ~$5M in Q2 2025—a 57-fold quarterly increase. The meme coin frenzy may have cooled since the 2024 “pump.fun” mania, but if SOL restaking matures, it could be Jito’s next growth driver.

Disclaimer:

1. This article is republished from TechFlow. Copyright belongs to the original author, chingchalong02. For any concerns about this repost, please contact the Gate Learn team. We will process your request promptly as per our procedures.

2. Disclaimer: The opinions expressed in this article are solely those of the author and do not represent investment advice.

3. Other language versions are translated by the Gate Learn team. Do not copy, redistribute, or plagiarize these translations without crediting @LidoFinance</a> has approximately 8.8M ETH staked, valued near $33B—accounting for 25% of staked ETH and 7% of total ETH supply. Lido is the largest on-chain ETH holder (sharplink: ~440K ETH; bitmine: ~833K ETH">Gate](http://gate.com/)..

While Lido is the undisputed ETH staking giant—often called “)](https://github.com/TurtleDotXYZ “@TurtleDotXYZ and @EulerFinance, <a href=”)

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer

Exploration of the Layer2 Solution: zkLink