The SEC decided to save itself, and a field of weeds grew wildly.

The Great Depression of 1929 set the stage for the Securities Exchange Act of 1934 and the founding of the SEC (U.S. Securities and Exchange Commission). Whether that’s a misfortune or a stroke of luck depends on your viewpoint—whether you see the world through the lens of e/acc accelerationism or believe in freedom via regulation. Since then, however, the SEC has never truly stopped the march of financial innovation or prevented a crisis.

In 1998, Long-Term Capital Management (LTCM) failed with its quantitative strategies on Russian debt, nearly repeating the cataclysm of 1929. That didn’t stop the Alternative Trading System (ATS) rules from going live in 1999, which helped quant, hedging, and arbitrage embrace information technology for good.

After the 2008 financial crisis, regulators cracked down on dark pools, but those private exchanges persisted. By 2025, in the wake of Gary Gensler’s departure, the SEC set its sights on the future—initiating a world where everything can go on-chain and compliance is possible for all.

- • On-Chain: Bringing real-world assets (RWA) on-chain is only the beginning. In the future, trading, asset allocation, and yield generation will all happen on-chain, making blockchain as fundamental as computers once were.

- • Compliance: Airdrops, staking, IXOs, and rewards are paving the way for a uniquely American Reg Super-App, making every facet of DeFi compliant and re-centered in the U.S.

The SEC’s Existential Crisis

The Great Depression brought the SEC to life; crypto may spell its end.

SEC Regulatory Pivot Timeline: Gensler exits —> Crypto Task Force —> Project Crypto

The signs are clear: The SEC’s regulatory shift can be divided into two phases—Gary Gensler’s removal in January, and the new crypto policy push after Chair Atkins took over in April. The creation of the Crypto Task Force was a key milestone, and by the end of July, Project Crypto marked the agency’s full capitulation to digital assets.

To understand why Project Crypto was launched, look at the SEC’s flurry of activity from April through July. During this stretch, the agency took several actions: on one front, lawsuits involving Ripple and Kraken required resolution with minimal damage, while on another, powerhouses like Coinbase and Grayscale became more assertive, pushing the SEC to relax its regulatory grip.

Most notably, the Ripple case marked the SEC’s pivot from an enforcement-first approach to regulation-as-a-service. Kraken’s IPO restart confirmed that U.S. regulators had fully embraced the crypto concept, and Robinhood began pursuing tokenized equity trading aggressively.

Approving spot BTC and ETH ETF staking and redemption is a watershed moment, but for the rest—more tokens, new formats—it’s still a case-by-case review. Even the Trump Group’s own ETF is still waiting in line for approval.

If anyone attempts to block America’s crypto ambitions, this is not a typical SEC—the response must be decisive.

Caption: The SEC’s Paradigm Shift in Crypto Regulation (2025)

Image source: @zuoyeweb3

This is why Trump chose a different playbook, backing the CFTC and supporting legislation like the Genius Act. With the CFTC on an expansion track and the White House’s crypto report essentially validating all current DeFi, regulatory changes accelerated.

The SEC had already delegated stablecoin oversight to banking regulators, and more digital asset policy has shifted toward the CFTC. What’s next for the SEC is now a very real question.

The highly anticipated Clarity Act hasn’t passed yet. If the SEC doesn’t act soon, it risks being completely sidelined by the CFTC—especially as stablecoin issuance increasingly intersects with the heart of securities law. The SEC must proactively carve out its regulatory perimeter through administrative actions before the Clarity Act hardens jurisdiction, ensuring its footprint is already established.

Still, the SEC’s powers under current law are limited. Whether it’s approving additional staking ETFs (such as SOL), launching ETFs for tokens without specific regulatory classification, greenlighting tokenized stocks and securities, or approving listings and Digital Asset Treasury & Custody Operators (DATCOs), the SEC has mostly opted to wait and delay, repeatedly postponing critical agenda items.

On July 17, rumors broke of a planned SEC-CFTC merger. Within days of Project Crypto’s debut, the CFTC quickly followed with its own Crypto Sprint—specifics aside, the signal was unmistakable.

The anticipated regulatory consolidation between the SEC and CFTC is expected to occur with the rise of crypto. For the SEC, maximizing its relevance means embracing the new paradigm and leaving old orthodoxy behind.

Real-World On-Chain Transformation

DeFi is now fully compliant, and the era of offshore arbitrage is over.

As already discussed, neither the Genius Act nor the Clarity Act provided tailored regulation for DeFi. The Genius Act addressed only stablecoins; the Clarity Act was too sweeping. Now, the SEC’s Project Crypto, from an administrative perspective, brings DeFi under compliance across people, assets, and rules.

For more, see: After the Genius Act: What Should the Clarity Act Focus On?

No need for foreign soil—talent is returning to the U.S.

In short, whatever offshore exchanges or foundations used to do can now be done right here at home.

Whether it’s stablecoins, IXOs, or tokenized assets (stocks, bonds), regulatory jurisdiction may be split, but as long as communication is clear, the SEC won’t randomly charge cases as illegal securities offerings.

On top of that, regardless of how the Tornado Cash founder’s case shakes out, the SEC has no intention of interfering; instead, it will protect developer safety and make the U.S. the go-to choice for builders, encouraging fair competition.

DeFi has clear rules—capital is coming back to the U.S.

Put simply, there’s no need for offshore shells or concerns over decentralization levels.

Every DeFi function—from token issuance and on-chain activity (staking, lending, trading, investing) to reward distribution—is now compliant. Notably, self-custody has been elevated to a core American freedom, and there is increased opportunity for all sorts of crypto staking ETFs.

Bottom line: Offshore regulatory arbitrage is no longer necessary—development, investment, and innovation can now occur domestically, supporting U.S.-based crypto advancement.

RWA are subject to clear rules: tokens live on U.S. chains.

In short, on-chain transformation is now the main theme.

Compared with DeFi, RWAs have even more precise regulatory frameworks—explicitly distinguishing equities, bonds, rights, and physical assets. The opportunity to tokenize stocks and private markets (pre-IPO) has significantly expanded.

This transformation will run deeper than the shift to computerization. From physical certificates to electronic trading, and now to fully on-chain assets, anything that can be financialized will be tokenized, closing the informational disparity between market participants—though this process will take years.

Ultimately, DeFi will stand as a new financial paradigm, not just a supplement to TradFi. Ethereum (ETH) will become the backbone of American financial dominance.

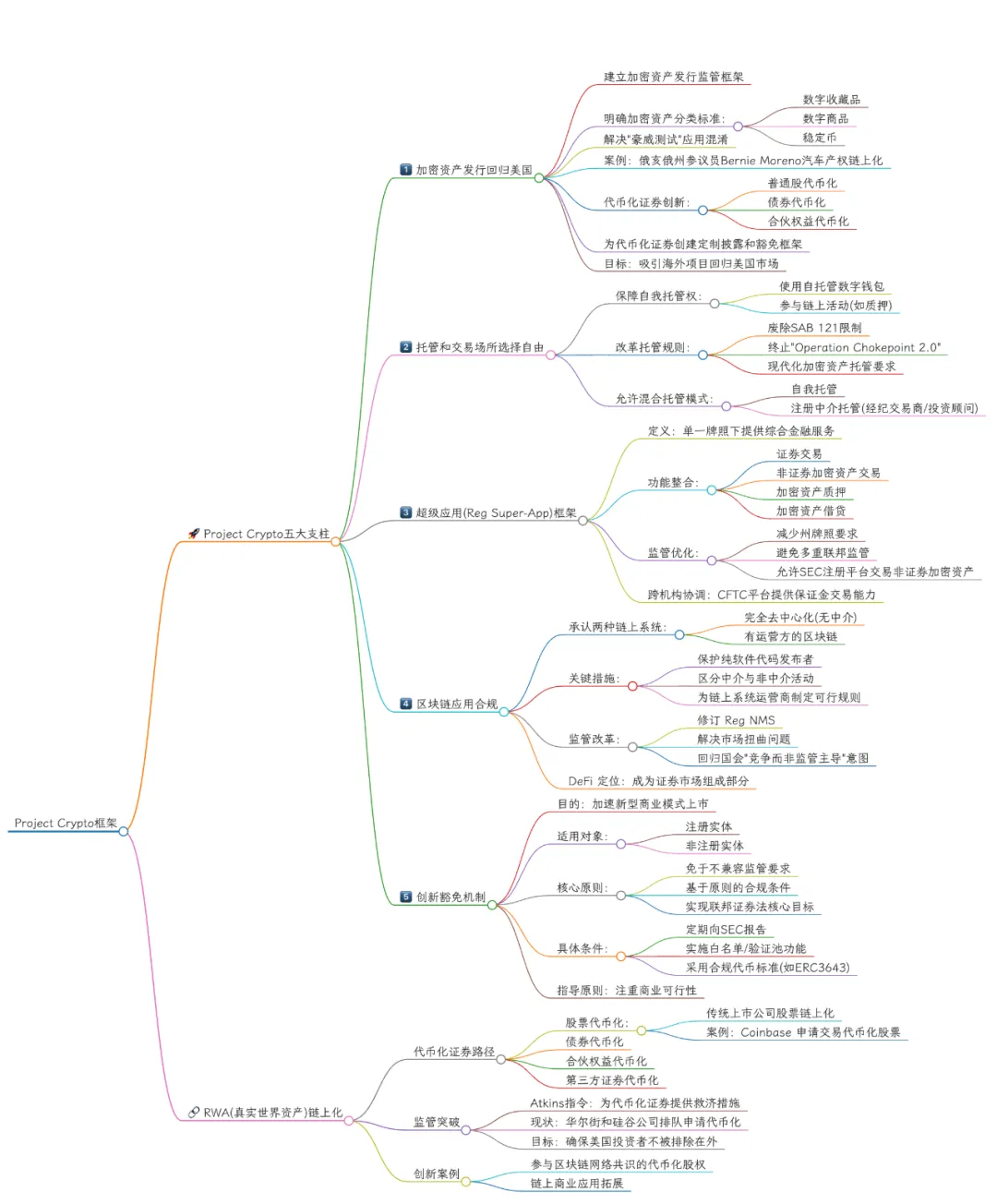

Caption: The SEC’s Project Crypto Framework

Image source: @zuoyeweb3

The heading of this section borrows from the slogan of Subzero Labs’ RWA Layer 1 project, Rialo. This time, RWAs are no longer synthetic or virtualized custodial issuance—any asset can be directly brought on-chain. For example, even newly listed Figma has kept the option to issue tokenized shares.

Stock equals tokenized equity; asset equals tokenized asset.

Conclusion

Is this the engine behind financial bubbles, or the inevitable road to asset innovation?

After today, Project Crypto could be called DeFi’s “Securities Law Moment.” How much of it actually gets implemented across agencies—and how much of it is accepted by Trump or Capitol Hill—remains to be seen.

However, the CFTC and SEC are expected to integrate due to the convergence of digital commodities and digital securities.

Disclaimer:

- This article is republished from [Zuoye Crooked Tree], with copyright belonging to [Zuoye Crooked Tree]. If you have concerns about this republication, please contact the Gate Learn Team, and the team will respond promptly in line with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of this article were translated by the Gate Learn team. Reproduction, distribution, or plagiarizing the translated article is strictly prohibited unless Gate is clearly cited.

Share