The Tokenization of U.S. Stocks: A New Narrative On-Chain

This article explains the concept and core value of U.S. stock tokenization and compares it with traditional U.S. equities. It provides an overview of the current market landscape, analyzes leading platforms and pioneers, explores the associated risks, and discusses the future potential of tokenized U.S. stocks.Overview

In recent years, blockchain technology and the cryptocurrency market have driven significant transformations in traditional finance. One of the most prominent trends is the tokenization of real-world assets (RWA), which includes assets such as stablecoins (e.g., USDT, USDC) and government bonds (e.g., BUIDL).

As technology matures and regulatory frameworks continue to evolve, tokenized U.S. stocks could emerge as the third major RWA asset class, following stablecoins and treasury bonds, offering enormous market potential and long-term impact.

Core Value

The U.S. stock market is the largest in the world, with a total market capitalization exceeding $50 trillion, featuring high-quality assets across technology, finance, and consumer sectors. However, the traditional U.S. equity market presents several limitations, such as high entry barriers, restricted trading hours, and cross-border investment complexity.

Tokenization transforms stock assets into digital tokens anchored on the blockchain, offering the following key benefits:

Global Accessibility: Tokenized U.S. stocks can be traded 24/7, eliminating geographical and time zone restrictions and enabling global investor participation at any time.

Fractional Ownership: Tokenization allows investors to purchase fractional shares of high-priced stocks (e.g., Apple or Tesla), significantly lowering the investment threshold and making stocks more accessible to retail investors.

Efficient Settlement: Blockchain enables T+0 or even real-time settlement, drastically improving transaction efficiency.

Lower Transaction Costs: Traditional equity trading involves multiple intermediaries, such as brokerages and exchanges, leading to higher fees. Tokenization, leveraging blockchain’s decentralized nature, reduces reliance on intermediaries and cuts costs.

Enhanced Liquidity: Tokenized assets can be integrated into decentralized finance (DeFi) protocols as collateral or trading pairs, significantly increasing their liquidity. U.S. stock tokens can also be used to build indexes and fund products within DeFi, expanding their use cases across the ecosystem.

These advantages make tokenized U.S. stocks attractive not only to traditional investors but also inject new energy into the crypto market.

Comparative Analysis

The following table compares tokenized U.S. stocks with traditional stock markets across various dimensions, including asset form, trading platforms, liquidity, and compliance. This comparison provides a clearer understanding of the advantages and challenges of tokenized U.S. stocks, offering investors a comprehensive view of both investment approaches.

Development History

The development history of tokenized U.S. stocks demonstrates its transition from an experimental concept to a mainstream application, driven by technological advancements, regulatory support, and growing market acceptance. Compared to stablecoins and government bond tokenization, tokenized U.S. stocks started later but have enormous potential due to the size (over $50 trillion) and diversity of the U.S. stock market.

Source:https://backed.fi/news-updates/backed-issued-tokenized-coinbase-stock-bcoin-on-base

Overview of the Current Situation

As of April 14, 2025, the total on-chain assets for Real-World Assets (RWA) globally are approximately $20.88 billion, with stock-related assets amounting to around $414 million, accounting for only 2% of the total on-chain RWA assets.

Within the stock-related assets, EXOD dominates the market with a 95.57% share, highlighting its market leadership. In contrast, TSLA and NVDA account for only 0.09% and 0.02%, respectively, despite these two stocks having large market caps and being highly followed in traditional stock markets.

Currently, the RWA tokenization market is still in its early stages, with EXOD potentially being a pioneer. However, tokenizing stocks from other large companies faces multiple challenges, including technological and regulatory hurdles.

Sources:https://app.rwa.xyz/stocks

Source: https://app.rwa.xyz/

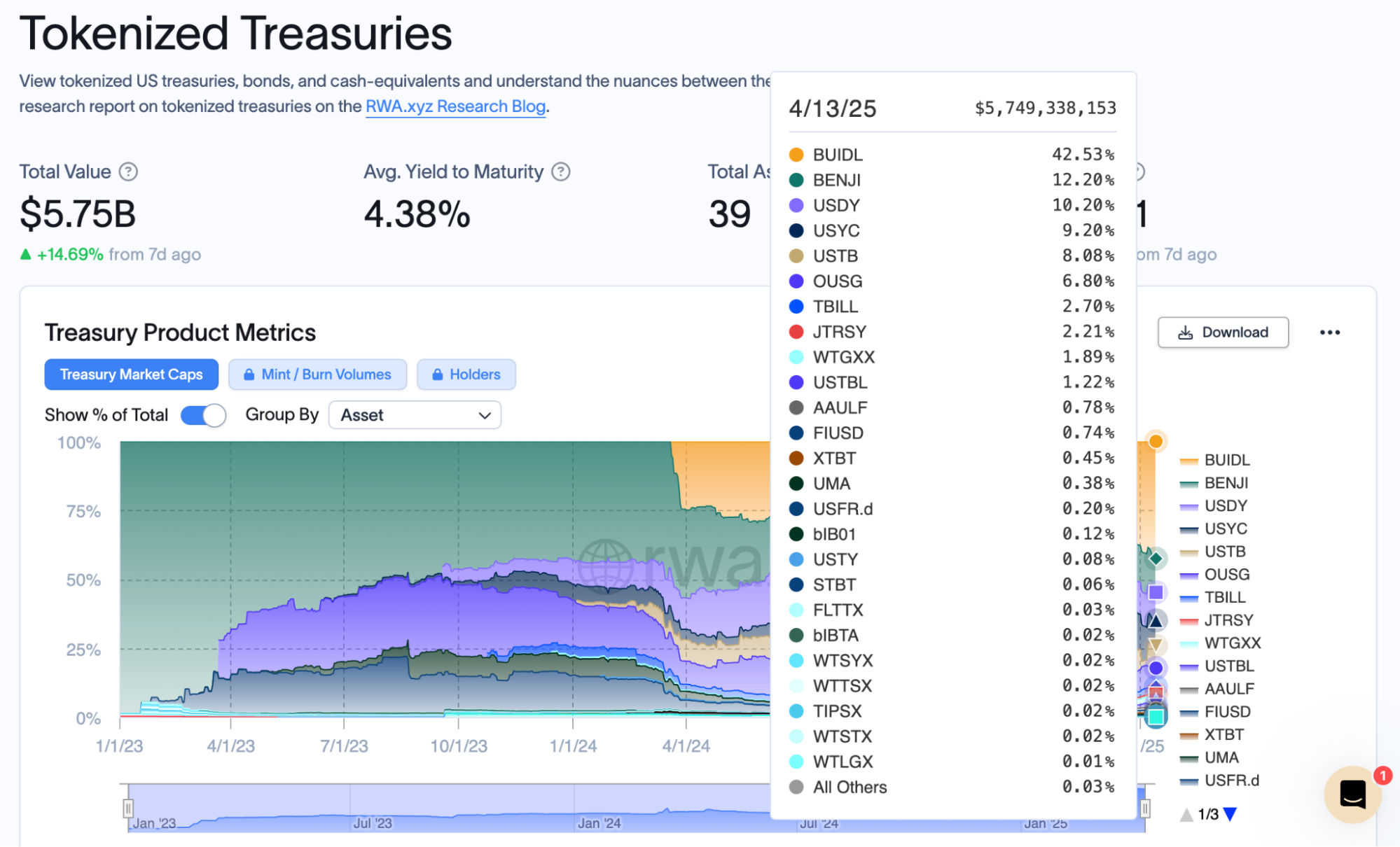

Compared to stablecoins and government bond tokenization, U.S. stock tokenization is more complex, but its market size and appeal are undoubtedly larger. As of April 14, 2025, the total market cap of stablecoins is approximately $233.65 billion, and government bond tokenization (such as Buidl) has rapidly reached $5.75 billion. If U.S. stock tokenization can overcome regulatory and technological bottlenecks, its scale is expected to surpass these figures quickly.

Source: https://defillama.com/stablecoins

Source: https://app.rwa.xyz/treasuries

Pioneer: Exodus Movement Inc. (EXOD)

Exodus Movement Inc. (EXOD) is a fintech company based in Omaha, Nebraska, USA, focused on blockchain and digital assets. Its core product is the self-custody cryptocurrency wallet (Exodus Wallet). EXOD’s stock tokenization is a significant case in the field of U.S. stock tokenization.

Tokenization Format:

Token Name: EXIT (now traded as EXOD)

Blockchain: Issued on the Algorand blockchain, with each EXIT token representing one share of Exodus Class A common stock, pegged 1:1.

Issuance Method: Issued in June 2021 through the Securitize platform under Reg A+ (a U.S. Securities law exemption), raising $75 million, with a total of 2.73 million shares issued.

Trading Platforms: Initially traded on Securitize Markets and over-the-counter (OTC) markets under the stock code EXOD. On December 18, 2024, EXOD began trading on the NYSE American under the ticker symbol EXOD.

Functions and Features:

Compliance: Approved by the U.S. SEC, requiring compliance with KYC/AML standards. Investments are available to qualified users in the U.S. and over 40 other countries.

Accessibility: Supports retail investors, with tokens stored in Exodus wallets, allowing unified management with other digital assets.

Efficiency: Blockchain technology enables fast settlement (e.g., dividend distribution) and transparent records, reducing intermediary costs.

EXOD tokenized stock combines innovation and growth potential, serving as a benchmark for U.S. stock tokenization. However, its high volatility requires caution. It is suitable for investors optimistic about RWA, but decisions should be based on market dynamics.

Source: https://app.rwa.xyz/assets/EXOD

Platform Overview

U.S. stock tokenization, as a key branch of Real-World Asset (RWA) tokenization, has seen the emergence of several representative projects in recent years. These projects use blockchain technology to digitize stocks, aiming to enhance trading efficiency, lower entry barriers, and increase liquidity. Below are some of the major representative projects, covering different types of technologies and compliance paths:

Securitize

Overview: Securitize is a platform focused on compliance tokenization of assets, partnering with traditional brokerages to issue digital securities pegged to U.S. stocks.

Features:

- Provides an SEC-compliant STO (Security Token Offering) framework to ensure KYC/AML compliance.

- Supports fractional ownership, allowing investors to purchase tokenized fractions of stocks such as Amazon, Tesla, etc.

- Utilizes smart contracts for real-time settlement and automated dividend distribution.

Progress: As of April 14, 2025, $2 billion in assets have been successfully tokenized on-chain. Securitize has tokenized multiple U.S. stock assets, with notable projects including Exodus Movement Inc. (EXOD), BlackRock’s U.S. Dollar Institutional Digital Liquidity Fund (BUIDL), and Arca U.S. Treasury Fund.

Significance: Securitize represents a compliant pathway for combining traditional finance with blockchain technology, attracting institutional investors.

Source: https://securitize.io/invest

Mirror Protocol (Early Exploration)

Overview: Mirror Protocol was a decentralized platform based on the Terra blockchain (now discontinued), which used synthetic assets to simulate U.S. stock prices.

Features:

- Users could trade tokenized U.S. stocks (e.g., Apple, Google) as mAssets without owning the actual stock.

- Real-time stock price data was sourced via oracles like Chainlink.

- Supported 24/7 trading, targeting global crypto users.

Progress: Mirror Protocol reached its peak between 2020-2021 but declined due to the collapse of the Terra ecosystem.

Significance: Although inactive, Mirror Protocol demonstrated the potential for decentralized tokenization and inspired subsequent projects.

Source: https://x.com/mirror_protocol

Dinari

Overview: Dinari is a California-based startup dedicated to the compliant tokenization of U.S. stocks, with investments from traditional financial giants such as Susquehanna.

Features:

- Focuses on converting U.S. stocks into blockchain-based security tokens, emphasizing compliance with U.S. securities laws.

- Uses regulated custodians to hold underlying assets, ensuring a 1:1 peg.

- Provides a user-friendly trading interface aimed at both crypto and traditional investors.

Progress: Launched a pilot in 2023, with expansion to additional U.S. stock offerings beginning in 2024.

Significance: Dinari represents a trend of emerging projects collaborating with Wall Street, with a focus on regulatory friendliness.

Source: https://sbt.dinari.com/tokens?orderType=0

Synthetix (Synthetic Asset Platform)

Overview: Synthetix is an Ethereum-based protocol that enables the issuance of synthetic tokens, known as Synths, which track U.S. stock prices.

Features:

- Tokens (e.g., sAAPL, sTSLA) do not hold actual stocks but simulate stock prices using oracles.

- Supports integration with the DeFi ecosystem, allowing tokens to be used for collateral, lending, etc.

- No KYC required, open to global users, though with lower compliance.

Progress: In 2023, Synthetix expanded its range of U.S. stock-related Synths, though some features were restricted due to regulatory pressure.

Significance: Synthetix demonstrates how decentralized finance can offer innovative solutions for tokenizing U.S. stocks, although compliance still needs improvement.

Source: https://x.com/ChainLinkGod/status/1385338143746924544

InvestaX

Overview: InvestaX is a tokenization platform based in Singapore, focusing on the issuance and trading of security tokens, including U.S. stock-related assets.

Features:

- Provides an end-to-end solution from issuance to secondary market trading.

- Supports SPV (Special Purpose Vehicle) tokenization structures for U.S. stocks, compliant with both Singapore and U.S. regulations.

- Allows both retail and institutional investors to participate, enhancing market accessibility.

Progress: In 2024, InvestaX tokenized equity stakes in some NASDAQ-listed companies, with steady growth in trading volume.

Significance: InvestaX showcases the potential of the Asian market in U.S. stock tokenization, emphasizing cross-border regulatory compliance.

Source: https://www.investax.io/

Risks

1. Technical Risks

Smart Contract Vulnerabilities: Tokenization relies on smart contracts on the blockchain, and if there are flaws in the code, it could lead to asset theft or transaction failures. For example, in 2023, Curve suffered from a vulnerability that resulted in a $70 million loss.

Blockchain Scalability Issues: Mainstream public blockchains like Ethereum may face high gas fees or transaction delays during peak times, limiting high-frequency stock trading scenarios. For instance, although the Base chain has lower costs, its stability for large-scale transactions remains unproven.

Network Attacks: Hackers could target blockchain nodes, wallets, or exchanges with attacks such as 51% attacks or phishing scams, threatening the security of tokenized assets.

Interoperability Issues: Tokenized assets must be able to interact across different chains or integrate seamlessly with traditional financial systems. If standards are not unified, it could lead to data silos or transaction failures.

Asset Custody Technology Immaturity: Tokenized assets need custody technology to ensure the existence and compliance of real assets. Although multi-signature and decentralized custody technologies are developing, they still face technical limitations and cannot fully guarantee asset security.

Wallet Management Risks: If users lose their private keys or mnemonic phrases, they could permanently lose their tokenized stock assets, and the irreversible nature of blockchain makes recovery nearly impossible.

Source: https://www.chainalysis.com/blog/curve-finance-liquidity-pool-hack/

2. Market Risks

Speculation and Volatility: Tokenized stocks may attract speculators, especially those using DeFi protocols to amplify leverage (e.g., 50x leverage tokens), which could increase market volatility. For example, on March 12, 2025, the decentralized perpetual contract exchange Hyperliquid saw a massive liquidation, with one trader controlling over $200 million worth of ETH with 50x leverage.

Liquidity Risk: Tokenized stock trading pools may lack depth, leading to slippage or the inability to execute trades, especially during market panic. In comparison to the trillions in traditional market liquidity pools, DeFi markets typically only have pools worth millions to hundreds of millions, which can lead to difficulties in executing trades during market fluctuations.

Market Manipulation: The anonymity of blockchain could be used for manipulation, such as “pump and dump” schemes, impacting the fairness of tokenized stock prices.

Lack of Investor Education: Retail investors may not fully understand the mechanisms of tokenized assets (such as on-chain settlement rules), leading to poor decision-making or falling victim to fraudulent projects.

Competition from Traditional Markets: If tokenized stocks do not offer significant advantages (e.g., lower costs or higher efficiency), they may struggle to attract traditional investors, limiting their market size.

3. Compliance Risks

Regulatory Uncertainty: The SEC’s vague classification of tokenized assets in the U.S. may lead to them being considered securities, requiring compliance with the Securities Act. If regulations tighten, tokenization platforms may face fines or even closure. For example, in 2021, Binance delisted tokenized stock trading pairs (such as Tesla and Google) due to regulatory pressure.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Requirements: The anonymity of blockchain could raise concerns about money laundering or illegal financing. Regulators may enforce strict KYC/AML processes, increasing operational costs and weakening the decentralized nature of these platforms.

Cross-Border Compliance Conflicts: Tokenized U.S. stocks may attract global investors, but differences in securities regulations across countries could lead to compliance challenges. For instance, China’s restrictions on cryptocurrency trading could hinder participation from some markets.

Tax Complexity: The trading of tokenized assets could trigger complex tax issues, such as capital gains tax or difficulties in tracking on-chain transactions, increasing the compliance burden for investors.

Enforcement Risks: If tokenization platforms fail to adequately address regulatory requirements, they may face asset freezes or legal actions, impacting user trust and asset security.

Source: https://www.cnbc.com/2021/07/16/crypto-exchange-binance-halts-stock-tokens-as-regulators-circle.html

Future Outlook

Stablecoins, due to their price stability and payment functionalities, are becoming pioneers for Real World Assets (RWAs), widely applied in cross-border payments and DeFi. Tokenized government bonds attract institutional investors due to their low risk and high credibility, filling the demand for secure assets in the crypto market. In contrast, tokenized U.S. stocks offer high growth and diversification, covering sectors such as technology, energy, and healthcare, catering to investors with different risk appetites.

If tokenized U.S. stocks progress smoothly, the market size could reach hundreds of billions of dollars within the next 5-10 years, becoming the third-largest pillar of RWAs. Below are the key paths to achieving this goal:

Technological Maturity: Layer 2 solutions like Ethereum and Polygon will reduce transaction costs and improve the on-chain efficiency of tokenized assets.

Regulatory Clarity: Clear regulations on tokenized assets from major global markets (e.g., the U.S. and the EU) will greatly boost industry confidence.

Ecosystem Integration: If tokenized U.S. stocks can seamlessly integrate into the DeFi and NFT ecosystems, it will foster more innovative scenarios, such as stock collateralized lending and index tokens.

Institutional Push: Deep collaboration between traditional finance and blockchain will accelerate the tokenization process, as seen in brokerage firms launching tokenized stock trading platforms.

Conclusion

In the context of the rapid development of blockchain and cryptocurrency, the tokenization of real-world assets (RWAs) is emerging as a significant trend. As a key direction in this area, the tokenization of U.S. stocks demonstrates substantial market potential and innovation opportunities. With blockchain technology, traditional assets like U.S. stocks can achieve 24/7 global trading, lower investment thresholds, and increased liquidity.

Currently, tokenized U.S. stocks are still in their early stages, with representative projects like EXOD holding a small market share. However, their growth potential should not be underestimated. As more traditional financial institutions get involved, the scale and application scenarios of tokenized U.S. stocks will continue to expand, potentially becoming the third-largest RWA asset class after stablecoins and government bonds.

Despite facing multiple challenges, including regulatory uncertainty, technical risks, market liquidity issues, and operational risks, this market is expected to gradually mature as technology advances and regulations become clearer, thereby becoming an important tool for global investors. Therefore, investors should carefully assess the risks and make decisions based on their risk tolerance.

Overall, despite the uncertainties and risks associated with tokenized U.S. stocks, their future development prospects are promising, making them worthy of continued attention.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Reshaping Web3 Community Reward Models with RWA Yields

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

ONDO, a Project Favored by BlackRock

Gate Research: Web3 Industry Funding Report - November 2024